Pushing finance to a higher level with scientific software engineers

After the credit crisis, banks and insurers have become a lot more cautious. This can be seen from the financial models that are used: they are getting increasingly more ingenious and complex, partly due to new insights and stricter regulations. Risks of products are better assessed, more advanced investment strategies are implemented and more aspects are included in order to assess the financial market more realistically. The tendency is that more and more highly skilled engineers are hired to support this complex matter. These technical experts prove their value in finance. In this blog, we will go into this further based on a number of relevant finance projects that have been carried out at VORtech.

Advanced optimization of business investments

One of the complex issues that VORtech has dealt with is identifying the best investments a company can make in its business assets. Our customer uses a risk-based investment strategy for this. Together with an American IT partner this has been implemented in a software tool. In the strategy, the investment plans are weighted based on their impact on the removal of business risks, performance and costs. This goes fairly well for one year, but carrying out a multi-year analysis appears to be very difficult in practice.

VORtech helped the customer to solve this problem. The financial problem was approached as a mathematical optimization problem. Here, the values of variables are calculated that optimize a so-called target function with one or more criteria.

The mathematical trick we have come up with is to define the variables in multiple dimensions, with each dimension representing an investment year. After processing this trick in the mathematical problem, we focused on finding a good and quick solution. We have demonstrated with various test cases that the solution is fast and adequate.

The customer was satisfied with this: the optimization process of investing over several years could be designed much better. Innovative mathematics provided the decisive factor. Our advanced implementation is now also a module in a large software package from the American software partner. Together with the customer and this software partner, we also published the article “Strength in numbers” in the journal Assets.

Clever implementation of an automated trading strategy

Quite recently we have optimized stock portfolios for another customer. We started with data from the Bloomberg database that we retrieve automatically in MATLAB. Then we implemented and tested a mathematical model for the client from scratch. This shows that practically automatic trading can be done on the stock market.

Erwin Mulder, scientific software engineer at VORtech, says: “It was a great exercise for me to work out existing ideas. MATLAB is a natural choice for this application. In the project we have worked closely with the customer to specify and solve the problem. At the same time, we have built the MATLAB code from scratch. We are glad to see that the program actually functions in the trading practice.”

Fast valuation of insurance products

For a customer in the insurance industry, we have been involved in the process of valuing complex insurance products. With each valuation, the customer performs a series of cash-flow calculations. Different market parameters are varied and different scenarios are calculated. The ultimate problem is highly dimensional. As a result, the original software tool needs too much computing time in order to calculate the outcomes.

VORtech has helped the customer by accelerating the software using high-performance computing (HPC). The code was parallelized, while maintaining the flexibility and transparency of the code.

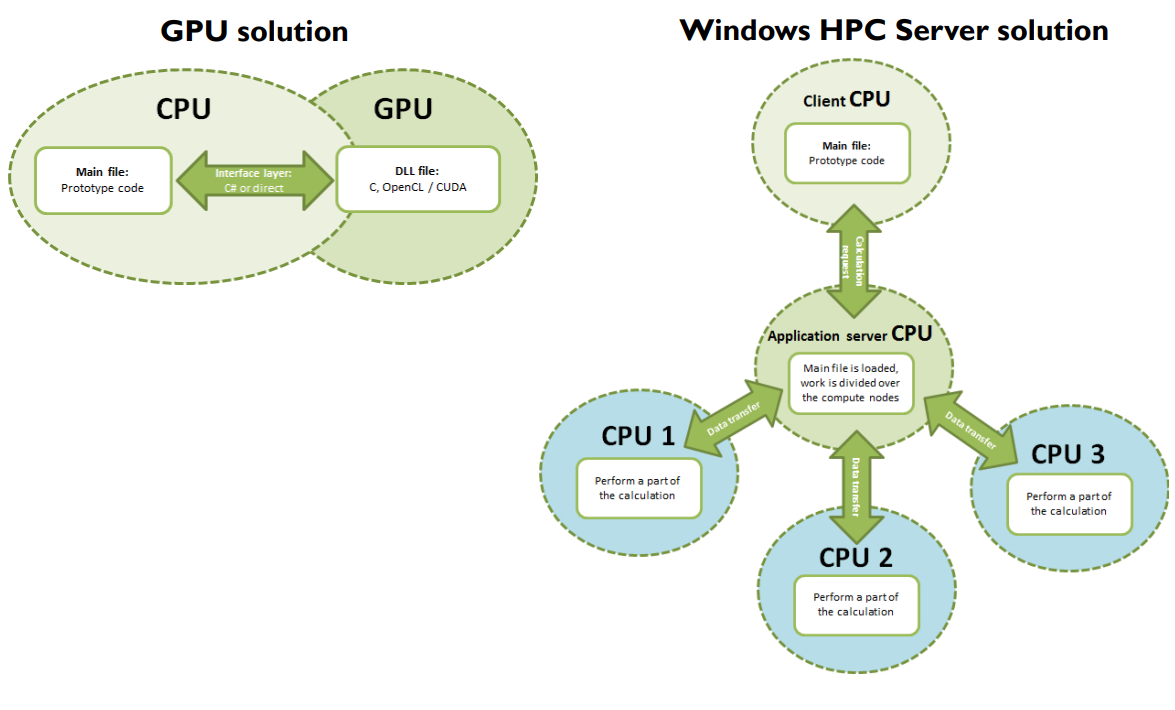

Two variants were elaborated. In the first variant, several graphics cards, or GPUs, were connected to each other. The programming language OpenCL is used for this. In the second variant, several computers were connected to each other. This parallelization was performed based on the so-called Windows HPC Server.

The difference between the two variants is both the hardware (graphics cards versus computers) and the programming language (OpenCL versus VBA). The first variant is considerably more efficient, but is a lot less transparent because many internal calculations are made at the graphics card. The second variant has the great advantage that it is completely transparent and corresponds to the original code.

By using HPC, the customer is able to carry out the required calculations faster and thus to better valuate their insurance products. This work, HPC for valuation of complex insurance guarantees, was also presented during a TopQuants event. An article about this has also been published in the TopQuants newsletter.

Jok Tang, a mathematical consultant and also the manager of the finance unit at VORtech, says: “We see more and more in finance that larger and more complex scenario and sensitivity analyzes need to be carried out.” On the one hand, this is demanded by regulators. And, on the other hand, the company wants to assess the risks even better in order to save costs and to keep the calculation times limited. The use of HPC is essential, and that is exactly the power of VORtech: we become enthusiastic about paralleling a complex piece. programming code, especially if we can help the customer move forward in their risk management “.

The next steps

More appealing finance cases will be discussed in a subsequent blog that will appear next month.

The future for technical experts in finance looks bright. Not only do they continue to deliver added value in the field of mathematical modeling and scientific computing, but also in the emerging data-science market (big data, data analytics, artificial intelligence and machine learning). Finance is an intriguing market where technical engineers will find a lot of fun and challenges in the coming years.